gst cash payout 2022

GST is a regressive tax which means it disproportionately affects the poor who spend a higher fraction of their income on goods and services. Disbursed in 2023 and 2024.

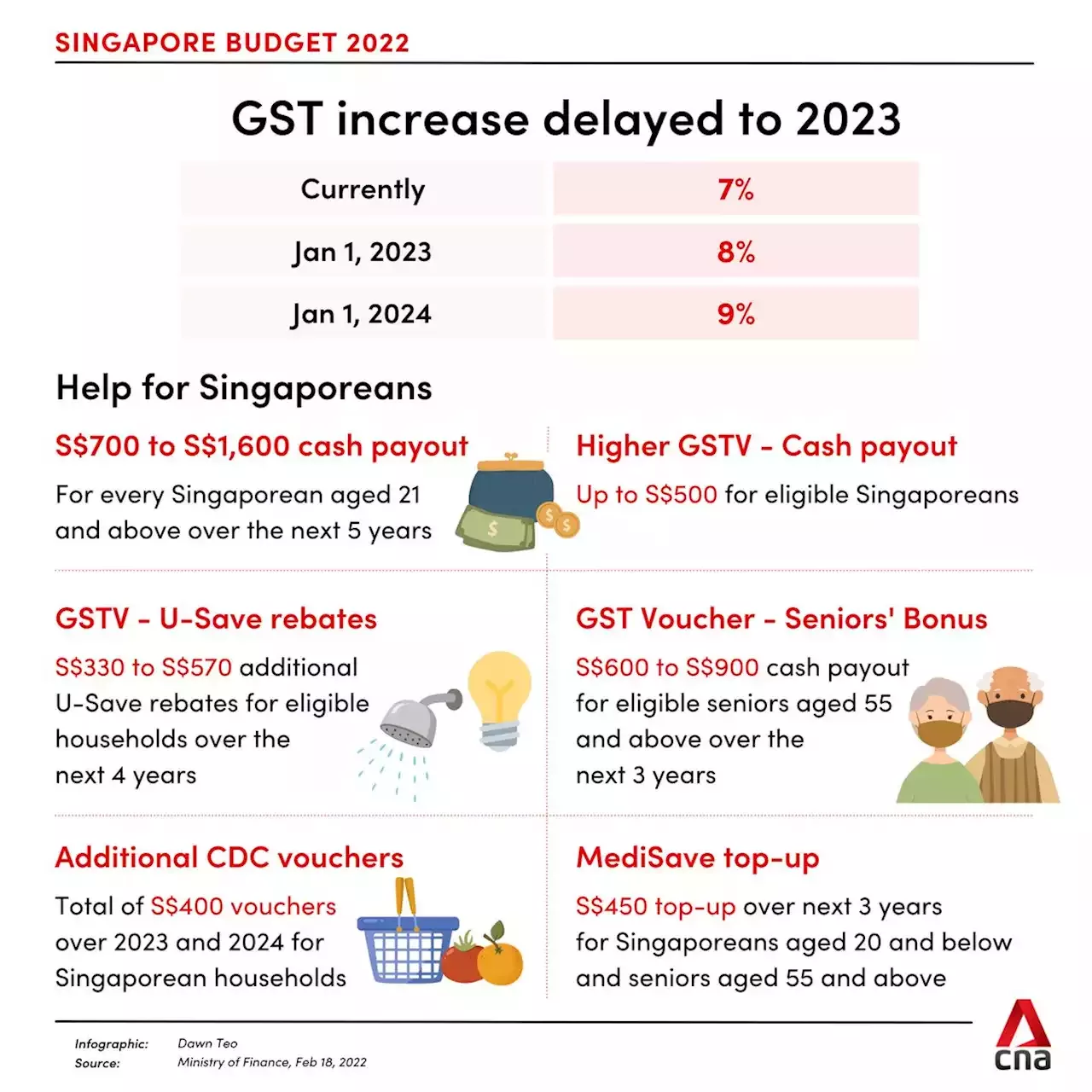

Gst Voucher Budget Announcements

15 hours agoPayout period.

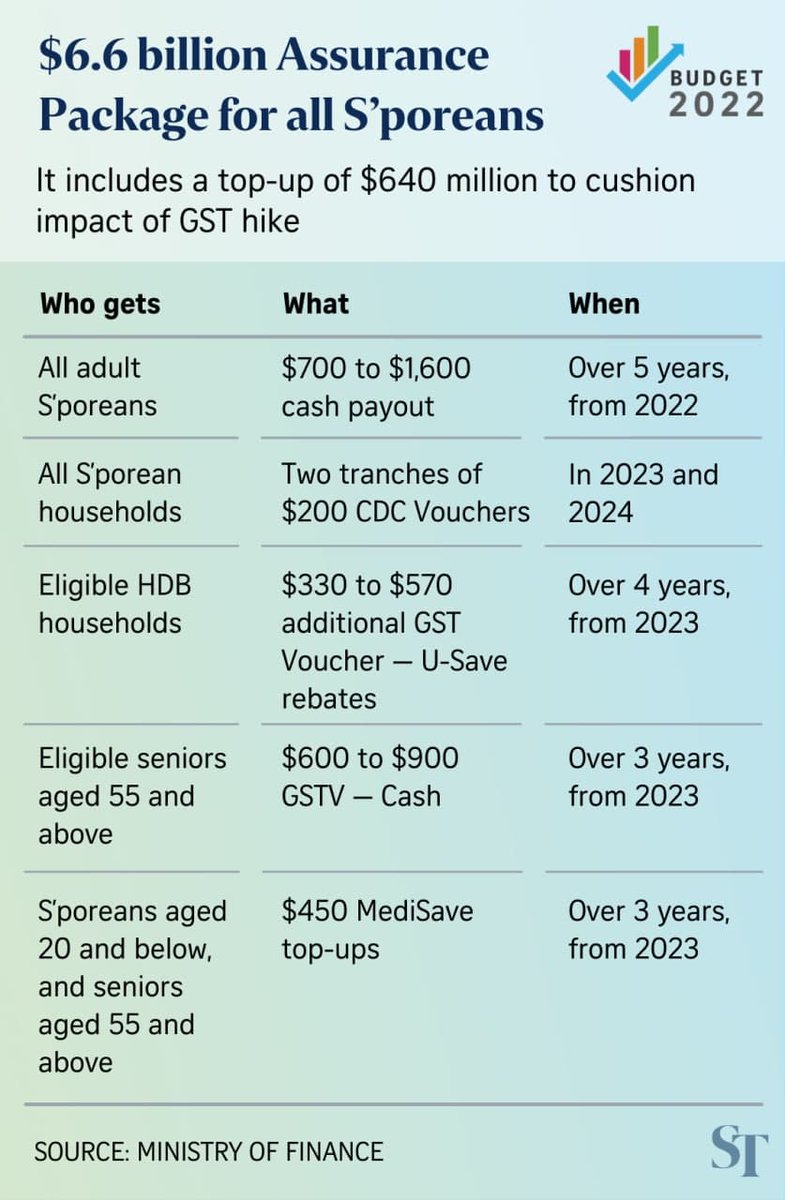

. We expect cash payouts to adult Singaporeans and an enhanced GST Voucher GSTV scheme which will mitigate the impact of the higher tax. Assurance Package to offset GST hike increased to S66 billion with cash payouts for all Sporean adultsSINGAPORE All Singaporeans aged 21 and above will receive cash payouts of up to S1600 which will be distributed over the next five years to help them deal with the impending increase in the Goods and Services Tax GST. GST law provides for issuance of credit note in case of excess payment of tax rejection or return etc.

For Singaporeans who own a single property or none at all those with annual income of less than S34000 will receive S1600 over the next 5 years. GST cash voucher payouts under the scheme will go up to either 250 or 500 with the exact amount depending on the value of ones. You can receive your payments via direct deposit to your Canadian bank account.

GST hike increase in utilities bills cash payouts over 5 years. 19 hours agoAll Sporean adults to receive S700 to S1600 cash payout over 5 years. The first payout will be made in December 2022.

GST VOUCHER CHEME IMPROVEMENTS The permanent GSTV scheme currently includes three components. Five years from 2022. If you are eligible and have signed up for a previous Government payout eg.

The 2020 GST Voucher you will receive your GST Voucher Cash Special Payment between June and July 2021 and GST Voucher Cash between July and August 2021 depending on your payment mode. Those with annual income of between S34000 and S100000 will get S1050. Earlier the time limit was up to Sept of the next financial year.

The payouts will be disbursed over five years from 2022 to 2026. 1 day agoGST Voucher 2022 payout date. The increase will also be imple.

Singapore Budget 2022. Four years from 2023. Top Changes made under GST Amendments in Budget 2022.

GST Notifications which come into effect from 1 st January2022. Extension of period for issuance of credit note along with the rectification of outward supplies already reported by a taxable person. Assurance Package to offset GST hike increased to S66 billion with cash payouts for all Sporean adults.

GST Voucher 2022 payout date GST is a regressive tax which means it disproportionately affects the poor who spend a higher fraction of. The permanent GST Voucher scheme was introduced by the Government in Budget 2012 to help lower-income Singaporeans. If youd like to view your benefit information and amounts you can do so using the.

It was actually implemented in order to enable Singapore to lower its corporate and income tax rates effectively shifting the burden of generating tax revenue to the poor. GST Registered taxpayers would be eligible to transfer their surplus E-Cash Ledger. Assurance Package increased to 66 billion GST voucher scheme beefed up to offset GST hike The GST rate will increase from 7 to 9 per cent in two stages - one percentage point each.

19 hours agoAll adult Singaporeans will receive cash payouts of between S700 to S1600 over 5 years from 2022 to 2026. Those residing in homes with annual values of below S13000 will see cash payouts increase from S300 to S500 by 2023. Citizens may check their eligibility details and update their payment instruction at the GST Voucher website.

Two tranches of S200 Community Development Council CDC Vouchers. The GST Voucher is given in three components - Cash Medisave and U-Save. Cash payouts MediSave top-ups and utility rebates.

950000 HDB households to receive GST Voucher rebates this Jan. 19 hours agoBudget 2022. As seen back in 2021 the GSTV cash payouts were allocated based on annual income and annual home value with caps of S28000 and S21000 respectively.

S700 to S1600 cash payout. Titled Charting Our New Way Forward Together this years Budget focuses on strengthening Singapores social compact as we progress into the post-pandemic world. Singapore is delaying its planned GST increase amid the ongoing COVID-19 pandemic rising inflation and a recovering economy.

Key takeaways from Budget 2022. S330 to S570 additional GST Voucher GSTV U-Save rebates. As part of a S66 billion Assurance Package to offset expenses from the GST hike.

Supply of goods by any unincorporated association or body of persons to a member thereof for cash deferred payment or other valuable consideration. The assessable income threshold for GST vouchers will increase from S28000 to S34000 to cover more Singaporeans. Time limit for issuance of such credit note is proposed to be extended to 30 th November of next financial year from the due date of filing the returns.

The payment dates can be found in the table below. A AP Cash Payouts Every Singaporean aged 21 years and above will receive cash payouts amounting to between 700 to 1600 depending on hisher income and property ownership see Table 1. The assessable income threshold for GSTV Cash will be increased from S28000 to.

The Canada Revenue Agency will pay out the GSTHST credit for 2022 on these dates. GSTHST Payment Dates for 2022. The GSTV scheme will now include the service and conservancy fees rebate as a permanent component.

Govt Proposes for the extension of deadline for claiming ITC. 2022 This provides additional support to families during this period of uncertainty. And those with annual.

Gst Payment Dates 2022 Updated Gst Hst Tax Credit Explained

S Etfqsysa0hm

Gst Payment Dates 2022 Updated Gst Hst Tax Credit Explained

Qzmuwhm2aup2hm

Jifi8nmy69vfpm

Ty9ljwtsnxtdrm

Gst Payment Dates 2022 Updated Gst Hst Tax Credit Explained

Klprpzold23 Gm

Hsdywnrojpciym

Nukoxrvuscy8zm

Gst Payment Dates 2022 Gst Hst Credit Guide Wallet Bliss

Gst Payment Dates 2022 Updated Gst Hst Tax Credit Explained

Gst Payment Dates 2022 Updated Gst Hst Tax Credit Explained

Gst Payment Dates 2022 Updated Gst Hst Tax Credit Explained

Gst Payment Dates 2022 Updated Gst Hst Tax Credit Explained