Calculate depreciation rate from effective life

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Depreciation Formula Examples With Excel Template

Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

. Determine the cost of the asset. How to Calculate Straight Line Depreciation. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

For example the diminishing value depreciation rate for an asset. It is calculated by dividing 200 by an assets useful life in years 150 if the asset was held before 10 May 2006. Name Effective Life.

Effective Life Diminishing Value Rate Prime Cost Rate Date of Application. Depreciation of most cars based on ATO estimates of useful life is. Monthly depreciation using the full month or actual days averaging.

Up to 8 cash back Annual depreciation by multiplying the depreciable value of the asset by the depreciation rate. You can use this tool to. Find the depreciation rate for a business asset.

Subtract the estimated salvage value of the asset from. Calculate depreciation for a business asset using either the diminishing value. Monthly depreciation using the actual days averaging method.

Its effective age is 15 years. What is the percentage depreciation and dollar depreciation if cost new is 60000. For most depreciating assets you can use the ATOs.

Up to 8 cash back Annual depreciation by multiplying the depreciable value of the asset by the depreciation rate. The straight line calculation steps are. Depreciation rate finder and calculator.

The calculator can also be used to ascertain the value of the car you will get on its sale. Total Economic LIfe. A house has a remaining economic life of 45 years.

The effective life is used to work out the assets decline in value or depreciation for which an income tax deduction can be claimed. This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following formula. Assets cost x days held.

Cost of running the car. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. Enter an effective life of 8 years the rate is 125 and the annual depreciation is 16250 100 8 125 1300 x 125 16250 Declining balance depreciation.

ATO Depreciation Rates 2021 Table A. The below types of formula can be used to calculate the depreciation rate.

How To Calculate Depreciation Youtube

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

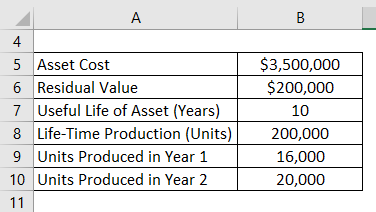

Unit Of Production Depreciation Method Formula Examples

Appliance Depreciation Calculator

Declining Balance Depreciation Calculator

Calculate Depreciation In Excel With Sum Of Years Digits Method By Learn Learning Centers Learning Excel

Depreciation Rate Formula Examples How To Calculate

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Car Depreciation Calculator

Depreciation Formula Examples With Excel Template

Depreciation Change In Useful Life Youtube

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

Pin On Accounting

Depreciation Calculation